capital gains tax proposal canada

The party released the PBOs costing of its campaign platform on Saturday. Unfortunately while there is a reduction in tax resulting from capital gains the result is paying tax on dividends when there is the potential to pay capital gains instead.

Ad For Private Placement Of Stock Google Search Accredited Investor Investing Real Estate Investing

A federal NDP campaign promise to increase the capital gains inclusion rate to 75 from 50 would bring in 447 billion over the next five years according to estimates released by the Parliamentary Budget Office.

. Capital gains tax on home sales a risky proposal experts say - National Globalnewsca Conservative Leader Erin OToole said. Capital gains tax on home sales a risky proposal experts say by brett bundale the canadian press posted september 10 2021 514 pm This has canada speculating again if a hike to the capital Over the last year there has been considerable speculation like most other things these days about the federal government increasing the inclusion. NDPs proto-platform calls for levying.

The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital gains inclusion rate. In our example you would have to include 1325 2650 x 50 in your income. The news release that accompanied the Proposals.

Your income tax rate bracket is determined by your net income which is your gross income less any contributions to registered investment accounts. Of the total 546 percent was declared by taxpayers with incomes over 250000. The Proposals include amendments to both the Income Tax Act ITA and the Excise Tax Act ETA.

In all Canadians realized 729 billion in taxable capital gains. Capital gains tax in Canada In Canada 50 of the value of any capital gains is taxable. The proposed increase would return the corporate rate to its 2010 level.

The proposal is so unpopular with voters that when a senior bank economist suggested in a research paper earlier this year that the principal residence exemption from capital gains tax be reviewed. For more information see What is the capital gains deduction limit. While alive the proposed increase to the capital gains tax could dramatically impact high-net-worth US.

Feb 7 2022. First there may be some renewed attention to how capital gains and wealth are taxed in Canada. Golombek says one tax-efficient strategy for individuals to realize capital gains is selling the securities to a new or existing Canadian holding company in.

Drafter123 iStockphoto. In other words if you sell an investment at a higher price than you paid realized capital gains youll have to add 50 of the capital gains to your income. Divide that number in half 50 and that.

One tax-efficient strategy for individuals to realize capital gains is selling the securities to a new or existing Canadian holding company in exchange for shares with an equivalent fair market. If your only capital gains or losses are those shown on information slips T3 T4PS T5 or T5013 and you did not file Form T664 or T664Seniors Election to Report a Capital Gain on Property Owned at the End of February 22 1994 you do not have to read the entire guide. When it comes to capital gains tax in the provinces capital gains is calculated the exact same way as it is federally with 50 of the capital gain being taxed according to your marginal tax rate.

Youre then taxed based on your particular provinces tax bracket. At its core the pipeline contains a simple strategy. More than 80 percent of gains were declared by the 95 percent of Canadian taxfilers with total incomes over 100000.

On a capital gain of 50000 for instance only half of that amount 25000 is taxable. In Canada 50 of the value of any capital gains is taxable. Guidance on affidavits and valuations Bill C-208 As of June 2021 changes to the Income Tax Act have altered the tax treatment of family transfers of shares in a qualified small business corporation and shares of the capital stock of a family farm or fishing corporation.

In Canada 50 of the value of any capital gains is taxable. The party says it will do this by leveraging federal infrastructure investments release at least 15 per cent of its real estate portfolio for housing while improving the Federal Lands Initiative defer capital gains tax when selling a rental property and reinvesting in rental housing explore converting unused office space to housing work. And the tax rate depends on your income.

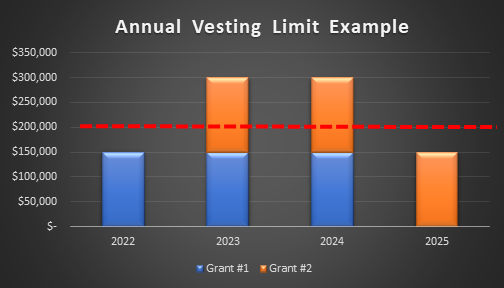

A pipeline plan is a tool used to avoid paying tax on dividends and pay tax on capital gains instead. Capital gains tax in Canada. The sale price minus your ACB is the capital gain that youll need to pay tax on.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for Canadian-controlled private corporations and 24-27 percent for individuals at the highest marginal rate depending on the province. On February 4 2022 the federal government released a package of draft legislation to implement various tax measures Proposals including some previously announced in the 2021 Federal Budget.

Here in Canada I see two consequences of the Presidents new tax proposals for our policy debates. A typical years capital gains tax rate is 10 to 12 22 to 24 32 to 35 or 37 on most assets. The amount of tax youll pay depends on.

Use Schedule 3 Capital Gains or Losses to calculate and report your taxable capital gains or net capital loss.

Canada Proposed Changes To Taxation Of Employee Stock Options Now Law Ey Global

Do You Know The Mortgage Processes I Will Be Adding All 5 Step Starting Tomorrow If You Would Like More Informatio Mortgage Process Mortgage Mortgage Lenders

Reduce Incentives For Speculation And House Flipping Liberal Party Of Canada

Surplus Stripping We Need To Fix Canada S Tax Rules Fon Commentaries Vol 2 No 4 Finances Of The Nation

What Could Be In The Federal Budget Wolters Kluwer

Ad For Private Placement Of Stock Google Search Accredited Investor Investing Real Estate Investing

Smythe Llp Possible Changes Coming To Tax On Capital Gains In Canada

Irs Tax Forms Form 1040 Schedule C Schedule E And K 1 For Business Irs Tax Forms Irs Taxes Tax Forms

Smythe Llp Possible Changes Coming To Tax On Capital Gains In Canada

This Week In Coins Prices Continue Downward Central African Republic Adopts Bitcoin Canada Says Nah Wa In 2022 Central African Republic Central African Republic

2022 Federal Budget Analysis Canada Life Investment Management Ltd

Banking Financial 12th July 2020 Awareness Banking Direct And Indirect Speech

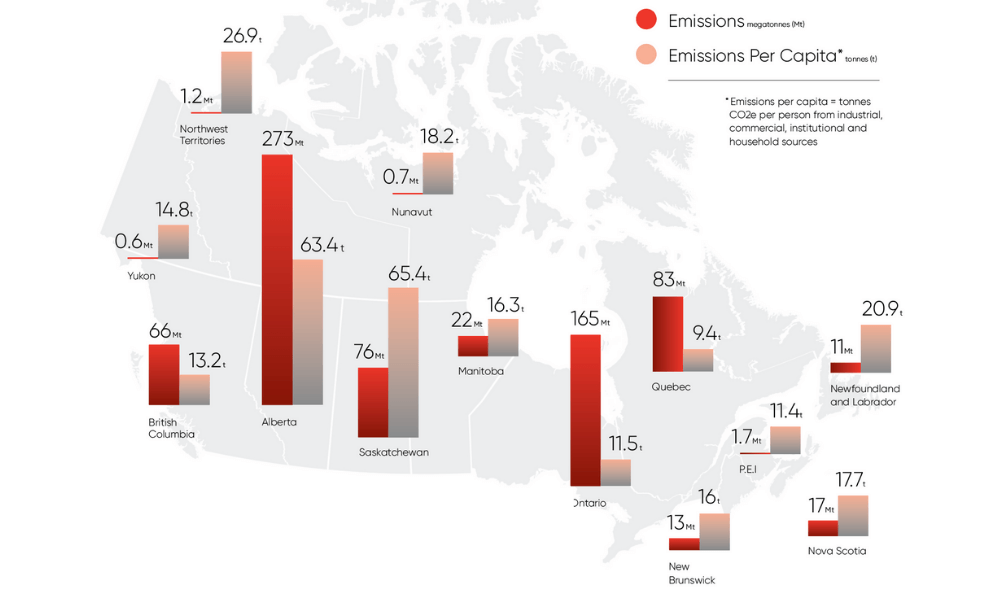

Net Zero Report Card How Future Friendly Are Canadian Provinces Corporate Knights

Pin By Canada Immigration Guide On Http Canadaimmigrationpath Com How To Apply Permanent Residence Instruction

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

Tashapb I Will File Your Uk Company Accounts And Tax Return For 105 On Fiverr Com Tax Consulting Corporate Accounting Filing Taxes

Reforming Canadian Fiscal Federalism The Case For Intergovernmental Disentanglement Ontario 360

Retailers Fiscal Future Laws Regulations Content From Supermarket News The American Taxpayer Relief Act Flow Chart Data Visualization Infographic Fiscal